Exploring Three Prominent UK Dividend Stocks

The United Kingdom stock market has shown positive momentum, rising 2.7% in the past week and achieving a 5.2% increase over the last year, with earnings expected to grow by 13% annually. In this buoyant environment, identifying dividend stocks that offer consistent payouts can be particularly appealing for investors seeking both stability and growth potential.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 8.19% | ★★★★★★ |

Dunelm Group (LSE:DNLM) | 7.68% | ★★★★★☆ |

Keller Group (LSE:KLR) | 3.93% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 5.97% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.86% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.11% | ★★★★★☆ |

NWF Group (AIM:NWF) | 3.59% | ★★★★★☆ |

James Latham (AIM:LTHM) | 3.02% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.50% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.98% | ★★★★★☆ |

Click here to see the full list of 53 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Vertu Motors

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vertu Motors plc is an automotive retailer in the United Kingdom, with a market capitalization of approximately £248.91 million.

Operations: Vertu Motors plc generates its revenue primarily from the retail sale of gasoline and automobiles, totaling approximately £4.44 billion.

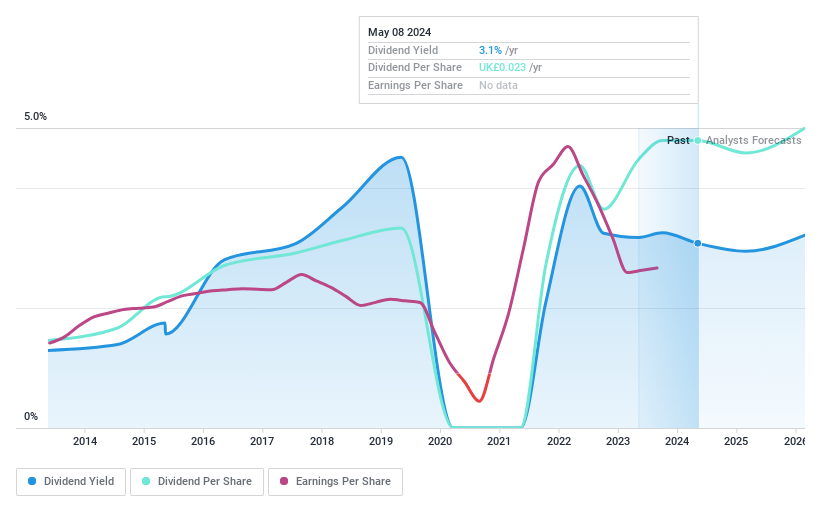

Dividend Yield: 3.1%

Vertu Motors has shown some resilience in its dividend strategy, maintaining a payout ratio of 29.7% and a cash payout ratio of 21%, suggesting dividends are well-covered by both earnings and cash flow. Despite this, the company's dividend yield at 3.08% remains below the top UK market performers. Additionally, while Vertu's price-to-earnings ratio is attractive at 9.4x against the UK market average, its net profit margin has halved to 0.6% year-over-year and recent financial data is outdated, posing potential risks for sustained dividend growth given an unstable track record over the past decade.

DCC

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DCC plc is a global company specializing in sales, marketing, and support services with a market capitalization of approximately £5.71 billion.

Operations: DCC plc generates revenue through three primary segments: DCC Energy (£15.10 billion), DCC Healthcare (£0.86 billion), and DCC Technology (£5.02 billion).

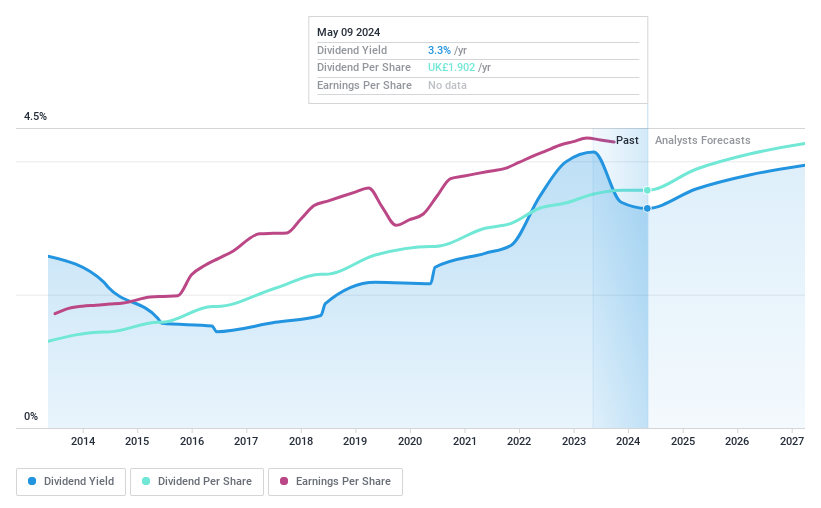

Dividend Yield: 3.3%

DCC's dividend sustainability is supported by a 57% earnings payout ratio and a 45.2% cash payout ratio, indicating that dividends are well-covered by both earnings and cash flows. Despite a lower yield of 3.29% compared to the top UK dividend payers, DCC has consistently paid reliable dividends over the last decade. The stock is currently trading at 40.5% below its estimated fair value, suggesting potential for price appreciation, with analysts predicting an average price increase of 20.8%.

OSB Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: OSB Group Plc is a specialist mortgage lending and retail savings company operating in the United Kingdom and the Channel Islands, with a market capitalization of approximately £1.77 billion.

Operations: OSB Group Plc generates its revenue primarily through its subsidiaries, Onesavings Bank Plc and Charter Court Financial Services Group Plc, which contributed £429.10 million and £230.20 million respectively.

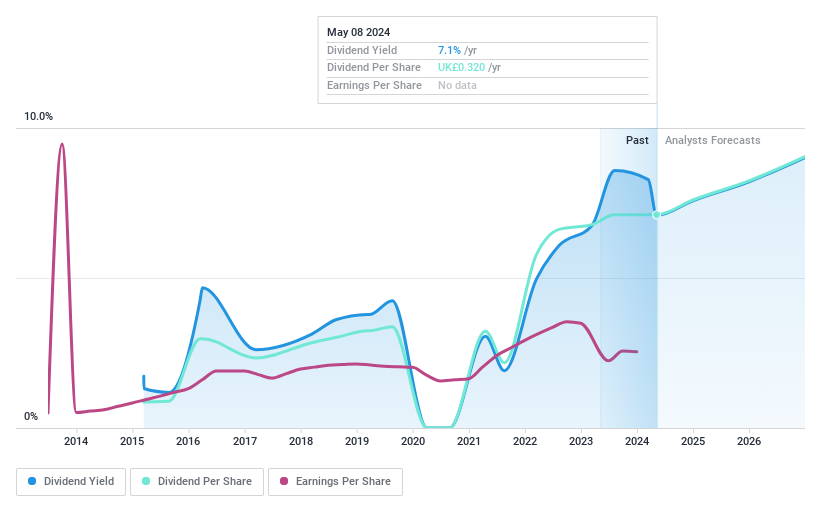

Dividend Yield: 7.1%

OSB Group's dividend appeal is nuanced. Despite a high yield of 7.09%, placing it in the top quartile for UK dividends, its history under 10 years shows volatility and inconsistency in payments. The company's payout ratio stands at 48.4%, indicating current earnings cover dividends, with forecasts suggesting improved coverage at 34.4% in three years. However, concerns persist due to a high bad loans ratio of 3% and low allowance for these at 19%. Recent board changes suggest potential strategic shifts but the impact remains unclear.

Delve into the full analysis dividend report here for a deeper understanding of OSB Group.

Upon reviewing our latest valuation report, OSB Group's share price might be too pessimistic.

Key Takeaways

Access the full spectrum of 53 Top Dividend Stocks by clicking on this link.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:VTULSE:DCC LSE:OSB and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com